As 2023 comes to a close, it is an appropriate time to reflect on EnerStar’s past, present and future. With our 85-year history, we have a strong foundation to build upon. We reflect on what we do well, and more importantly, where to improve. We developed a strategic plan that lays out our future. Therefore, in my year-end CEO column, I will share a co-op perspective on the past and the future.

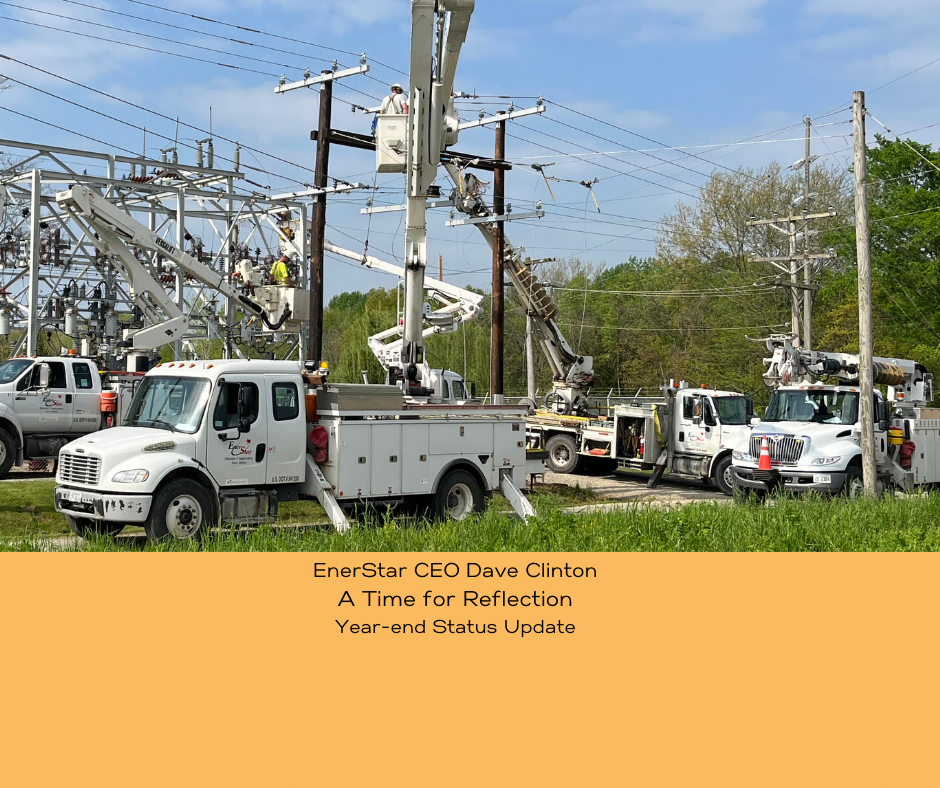

Improving distribution system reliability

Your co-op is committed to enhancing our distribution system to provide even better service. In the next three years, we plan to invest almost $10 million in upgrading our power lines, equipment, poles and substations. Our current metering system, installed in 2010, is reaching the end of its life cycle. As time passes, the meters and equipment required to operate the system are becoming increasingly difficult to find. For this reason, starting in 2024, we will install the latest-generation electric meters currently used in over 75% of American households. These meters offer advanced communication features, better performance reports and faster outage reporting.

Developing future-focused rates

Over the last 10 years, EnerStar has managed to limit the increase in its electric rates by only 7%, despite inflation rising by over 30% in the past decade. This achievement is due to our thoughtful financial planning and holding the line on controllable costs.

The utility industry is rapidly evolving with the rise of member-owned renewable generation, electric vehicles and electric batteries. EnerStar, like many other cooperatives, must adapt to these changes. While we support renewables as part of our power supply portfolio, we want to ensure that members who choose not to use them are not subsidizing those who do. Therefore, our rate structure must remain current, relevant and aligned with the driving force behind costs and unique demands for electricity from our members.

Electric rates consist of two primary usage components: the kilowatt-hour, which measures energy use, and demand, which measures average electricity consumption during a 15-minute interval. Usually, the more electrical devices used, the higher the demand.

To understand energy use and demand, let’s use the analogy of a bucket of water. We have two members, each needing 10 gallons of water. The first member filled the bucket in one hour, while the second member filled the bucket in 15 minutes by turning the water on at full blast. Although the amount of water is the same, how they got that water varied greatly. The same applies to electricity.

Under our current rate structure, we bundle the energy and the demand into one energy rate. But as the United States moves away from base-load electric generation, such as coal plants, and electricity consumption continues to increase, the price of the demand component of our wholesale power bill is rising significantly.

Thus, aligning members’ rates with how costs are incurred is becoming increasingly important to keep rates fair for all members. Therefore, we will begin unbundling these charges in the coming year. This structure is typical of other electric utilities.

As we modernize our rate structure with a cost-based design and upgrade our metering technology, we gain opportunities to offer attractive incentive electric rates for those members who are interested in taking advantage of cost-saving options.

Enhancing financial security and stability

During our annual meeting in June, we had a productive discussion with our members regarding our ongoing efforts to reduce debt. They confirmed our goals.

As I mentioned, it is a challenging time in the utility industry due to significant price increases of essential items required to operate an electric utility. For instance, electric poles cost up to 90% more, while transformers have increased by 50% over the past two years. These price hikes pose a significant challenge to our operations. Additionally, we continue to experience long lead times for acquiring the same equipment. Some transformers take several months or years to arrive, while utility trucks can take two to three years.

Considering these challenges, financial planning has become even more critical to our operations. Despite the significant cost increases, we have kept our controllable costs stable for the last five years while reducing our long-term debt by $1.7 million since January 2021. At the same time, we are significantly improving our electric system to enhance reliability.